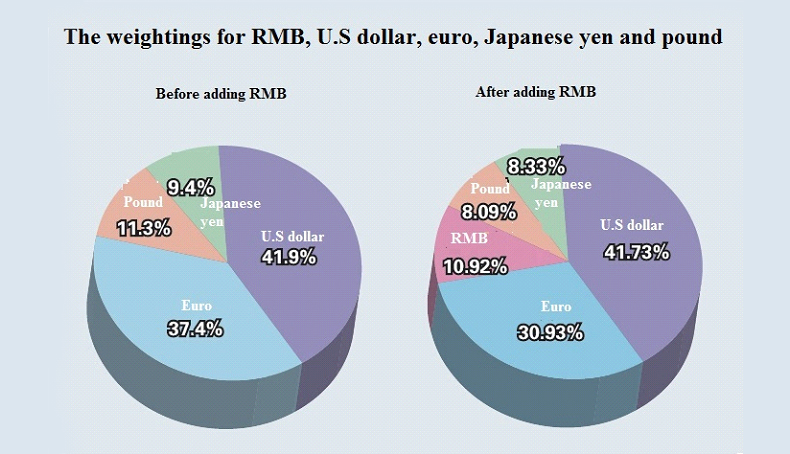

SDR stands for Special Drawing Rights, is a basket of currencies, a weighted average of currencies that includes the US dollar, Euro, the Chinese renminbi, Japanese yen, and British pound sterling. SDR can be thought of as a “measurement tape” rather than a basket of currencies for evaluating the world economy.

The value of the SDR was initially defined as equivalent to 0.888671 grams of fine gold which, at the time, was also equivalent to one US dollar. After the collapse of the Bretton Woods system in 1973, the SDR was redefined as a basket of currencies. Effective October 1, 2016 the SDR basket consists of the US dollar, euro, the Chinese renminbi, Japanese yen, and British pound sterling.

The value of the SDR in terms of the US dollar is determined daily and posted on the IMF’s website. It is calculated as the sum of specific amounts of each basket currency valued in US dollars, based on the spot exchange rates observed at around noon London time.

The basket composition is reviewed every five years by the Executive Board, or earlier if the IMF finds changed circumstances warrant an earlier review, to ensure that it reflects the relative importance of currencies in the world’s trading and financial systems. In the most recent review (concluded in November 2015), the Executive Board decided that, effective October 1, 2016, the Chinese renminbi met the criteria and was included in the SDR basket.

Jim Rickards, CIA consultant, said he thinks the actual US debt and deficits will end up even worse than projections, “pushing the US closer toward a true crisis of confidence in the dollar. Jim Rickards also suggested a new currency (I don’t know what he called it) based on SDR that is an IMF unit for currency.

The problem with CIA solution is that most of these currencies are floating against one another in an ongoing currency war between the member States (China, US, Japan and Europe). Donald J Trump tweeted: “Russia and China are playing the Currency Devaluation game as the U.S. keeps raising interest rates. Not acceptable!”

Moreover Peter Schiff reported that “Global debt has reached record levels. According to a recent IMF report, the world has amassed $164 trillion of debt. Three countries account for half of the total global debt – the US, China and Japan.” I remind you that US, china and Japan are the major currency constituents of SDR. So how could SDR be sustainable?

As of today, the Central Banks of SDR Member States have printed some $23 Trillion of EXTRA currencies that is forcing the world into a spiral of inflation and currency wars leading to a global “HOT WAR” involving militaries, i.e. WW III.

Moreover, Jim Rickards approach acts as a Band-Aid and will kick the problem down to the future for another 10 to 15 years. It is NOT a permanently sustainable solution.

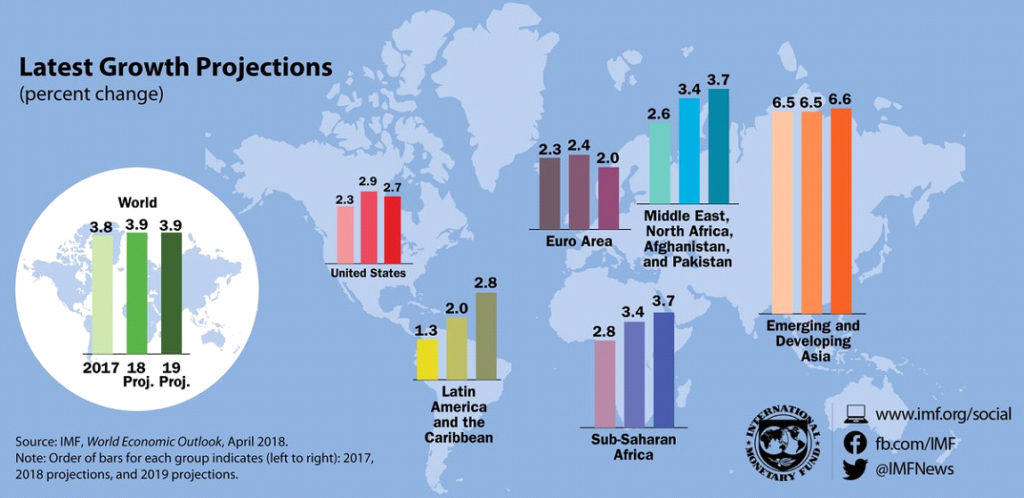

The IMF just published this chart and said: “The current upswing in the global economy provides an ideal opportunity to make future growth stronger and more inclusive”. The problem is that the Central Banks are too weak to sustain such a growth, and the free market capitalism is replaced by crony capitalism led by the Central Banks and their friends. And the world is experiencing a “Currency War” that could lead to a “Hot War.” So IMF projected growth is not sustainable.